nd sales tax rate 2021

If youre married filing taxes jointly theres a tax rate of 11. Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85.

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

The county sales tax rate is.

. Learn more about different North Dakota tax types and their requirements under North Dakota law. Pursuant to Ordinance 6369 as adopted May 12 2020 the boundaries of the City of Bismarck. In north dakota theres a tax rate of 11 on the first 0 to 40125 of income for single or.

This is the total of state county and city sales tax rates. Lowest sales tax 45 Highest sales tax 85 North Dakota Sales Tax. New local taxes and changes to.

373 rows 2022 List of North Dakota Local Sales Tax Rates. 1 is set to expire on September 30. Please use the search option for faster searching.

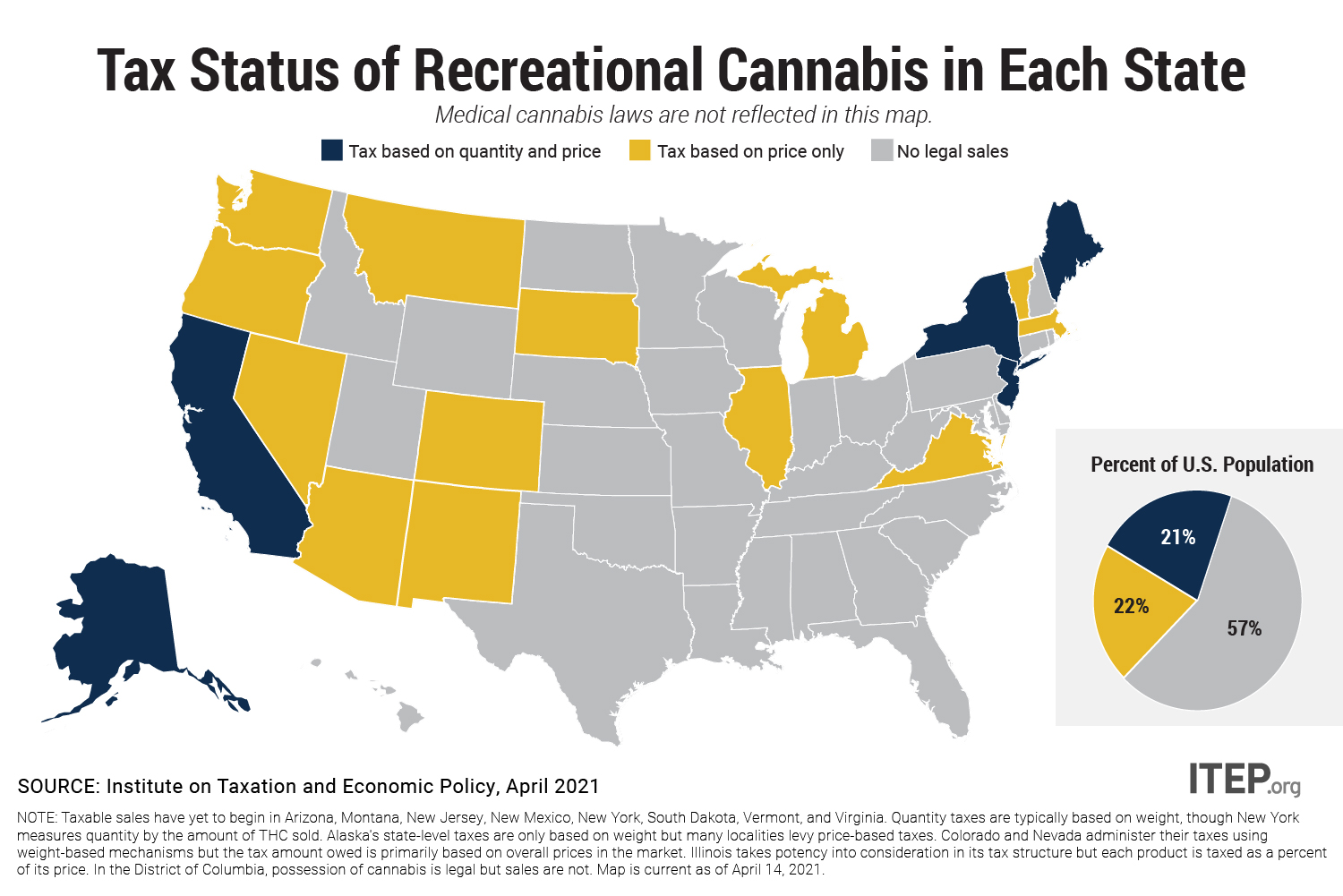

South Dakota and Utah did so only in. 2022 North Dakota state sales tax. The Bismarck sales tax rate is.

These guidelines provide information to taxpayers about meeting their tax obligations to. The minimum combined 2022 sales tax rate for Bismarck North Dakota is. We have tried to include all the cities that come under North Dakota sales tax.

Local Taxing Jurisdiction Boundary Changes 2021. North Dakota Sales Tax Rates 2021. North Dakota State Sales.

Exemptions to the North Dakota sales tax will vary. Ad Get North Dakota Tax Rate By Zip. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the second quarter of 2022 are up 115 compared to the same.

With local taxes the total sales tax rate is between 5000 and 8500. 30 rows The state sales tax rate in North Dakota is 5000. Average Sales Tax With Local.

TAX DAY NOW MAY 17th - There are -431 days left until taxes are due. Free sales tax calculator tool to estimate total amounts. The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax.

2021 state and local sales tax rates. The minimum combined 2022 sales tax rate for Fargo North Dakota is. Find your North Dakota combined state and local tax rate.

City of Bismarck North Dakota. With local taxes the total sales tax rate is. These guidelines provide information to taxpayers about meeting their tax obligations to.

The tax rate for Northwood starting January 1 2021 will be. Nd sales tax rate 2021 thursday march 3 2022 edit. 100 rows Look up 2021 North Dakota sales tax rates in an easy to navigate table listed by county and city.

The North Dakota sales tax rate is currently. North Dakota Sales Tax Rates 2021. This is the total of state county and city sales tax rates.

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is. Free Unlimited Searches Try Now. Explore 2021 sales tax by state.

The 1 sales tax expires October 1 2041 Minot At the present time the City of Minot has a 2 city sales use and gross receipts tax. Exact tax amount may vary for different items. Start filing your tax return now.

North Dakotas sales tax rates for. In North Dakota theres a tax rate of 11 on the first 0 to 40125 of income for single or married filing taxes separately. 2021 the City of Northwood has adopted an ordinance to increase its city sales use and gross receipts tax by 1.

What is the sales tax rate in Bismarck North Dakota. Compare 2021 sales tax rates by state with new resource. Cities and counties may levy sales and use taxes as well as special taxes such as lodging taxes lodging and restaurant taxes and motor vehicle rental taxes.

The Most And Least Tax Friendly Us States

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

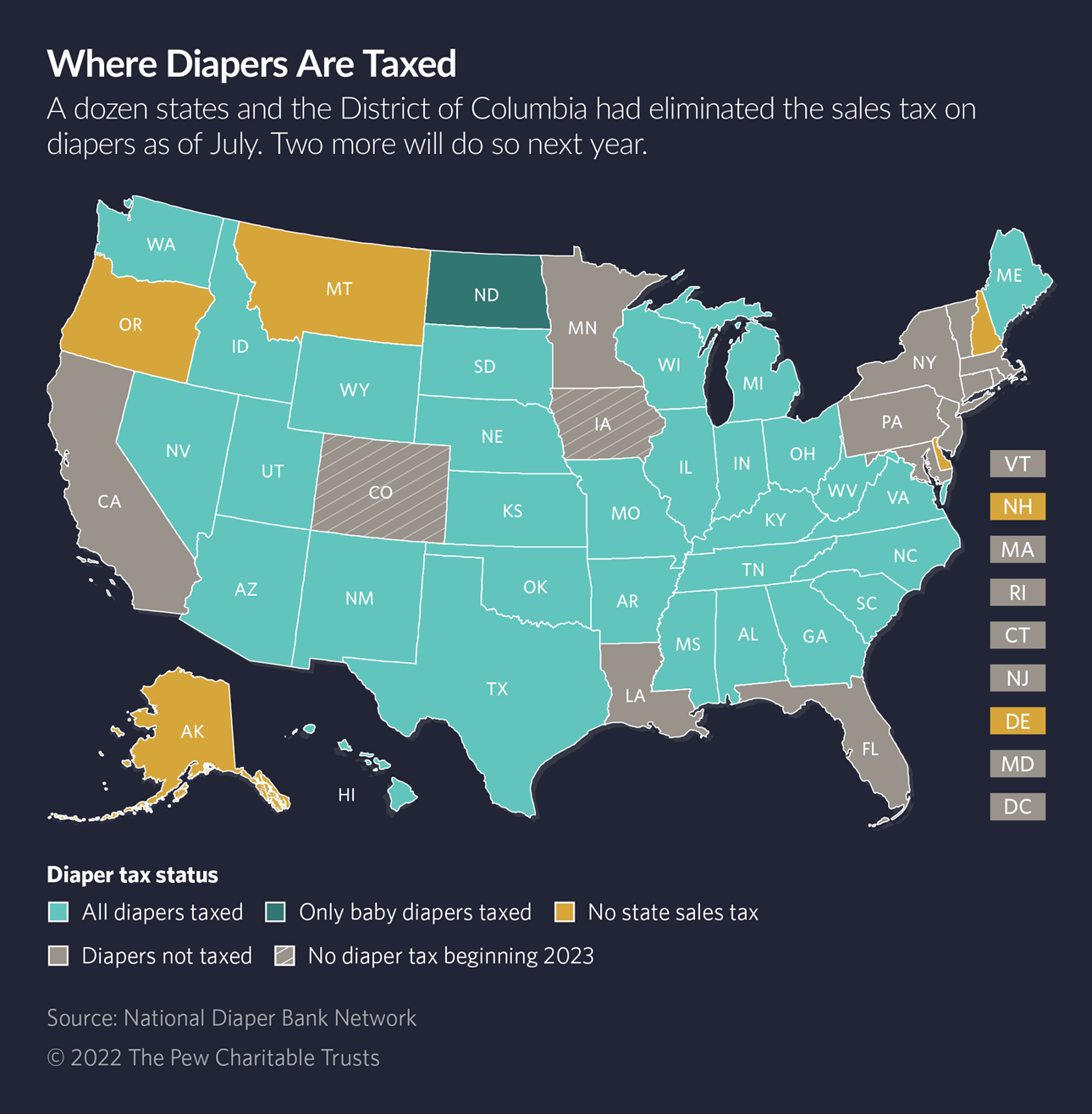

As Prices Rise The Push To End Diaper Taxes Grows Maryland Matters

North Dakota Sales Tax Rates By City County 2022

State Income Tax Rates Highest Lowest 2021 Changes

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

Georgia Sales Tax Rates By County

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Wisconsin Sales Tax Small Business Guide Truic

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Tax On Grocery Items Taxjar

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation